Looking over an employer-provided insurance plan summary can often feel like you’re reading something in another language. In all fairness, you sort of are. Those summaries, which are supposed to be easy for anyone to understand, are full of industry terms almost meaningless to the general public. The problem is, as confusing as they are, all of those terms are important, and you don’t want to find yourself getting a crash course in what they mean as you’re sitting in an ER and a hospital billing staff member is asking you to pay your $400 copay before they proceed to treat you.

While having a general understanding of your insurance benefits is essential in emergencies, it’s also crucial in less extreme circumstances, from your child’s yearly well visit to your dental cleaning to your pre and post-natal care. If your employer offers multiple plan options or can use your partner’s insurance, understanding the terminology and how it will impact your life can help you make the best financial decision. Also, it may not be as simple as choosing whichever plan costs less.

Health Insurance Terminology 101

First and foremost, to understand the benefits, you need to translate the industry jargon into a language you can understand. Here are some common words or phrases you’ll come across when you’re evaluating your benefits, and a brief explanation for what they mean:

Premium: How much it costs you to simply have insurance (often, this is taken directly from your paycheck if you’re on an employer-provided plan). Typically, plans with lower deductibles have higher premiums.

Deductible: Flat amount of money that you have to pay out of pocket before your insurance company starts paying their portion of your medical bills. There are usually parameters around which payments are applied to your deductible, which is important to look for when evaluating your plan.

Example: If you are on an 80/20 plan (where your insurance pays 80% of the cost of your medical bills and you are only responsible for 20%) and you have a deductible of $500, that means you have to pay $500 out of pocket before your insurance company will start covering 80% of your bills.

Co-Insurance: The portion of a medical bill that is your responsibility after you’ve met your deductible and your insurance provider starts covering the cost of services.

Example: If you are on an 80/20 plan, your insurance covers 80% of the bill and your co-insurance is 20% of the bill.

Out-of-Pocket Maximum: This is the maximum amount of money you will have to spend on healthcare services in a given year. Typically every dollar you spend on your medical bills for services covered by your insurance provider is applied to this number (unlike your deductible).

Co-Pay: A predetermined flat amount that you will pay for specific appointments and services. This amount can vary based on appointment type/provider. The amount you spend on co-pays is often applied to your Out-of-Pocket Maximum limit, but not towards your deductible.

Covered Services: The costs your insurance provider will pay.

Example: A dermatologist appointment to check for skin cancer might be a covered service, but a dermatologist appointment for cosmetic Botox likely is not.

Plan Limits: Your insurance provider will stop covering their portion of these services after a certain number of visits.

Example: You have a plan limit of 30 chiropractor appointments in a year, so you are financially responsible for any appointment beyond that limit.

Pre-Authorization: You or your healthcare provider have to call your insurance company for authorization (permission) before certain services, medications, or treatments are administered/prescribed for your insurance provider to cover the cost.

In-Network: Healthcare providers, hospitals, groups, etc., that your insurance company has a contract with are considered “In-Network,” and the amount you have to pay to see them is typically significantly lower than if you were to have the same appointment/procedure out-of-network.

Out-of-Network: Healthcare providers, hospitals, groups, etc., that your insurance company does not have a contract with. You will have to pay more for these services, and the amount you pay is applied to a separate “out-of-network deductible” and “out-of-network out-of-pocket maximum”.

Primary Care Provider: This may be called your PCP or GP (general practitioner), and is often the doctor you see for sick visits, annual physicals, yearly vaccines, blood draws, etc. Some insurance plans offer a slightly discounted co-pay if you have an established PCP that is in-network.

Specialist: Providers you see for specific purposes such as a cardiologist, gastroenterologist, or orthopedic surgeon. Co-pays for visits with specialists are typically more expensive than those for a primary care provider.

Outpatient: This refers to procedures or exams that go beyond standard appointment services, are done in the provider’s office or surgical center, and don’t require you to be hospitalized for observation.

Examples: Tonsillectomy, minor orthopedic surgery, or a standard mole removal.

Inpatient: Treatment and services that require you to stay onsite overnight (or for multiple days) at a hospital or other healthcare facility.

Examples: Labor and delivery, major surgery, or long-term treatment for an illness or condition.

This is just scraping the surface, and there are often plan-specific caveats to some of these general rules. That being said, having even a broad understanding of what these terms mean will allow you to evaluate your benefits better and advocate for yourself/your family if medical bills come due and you’re getting overcharged.

Extras

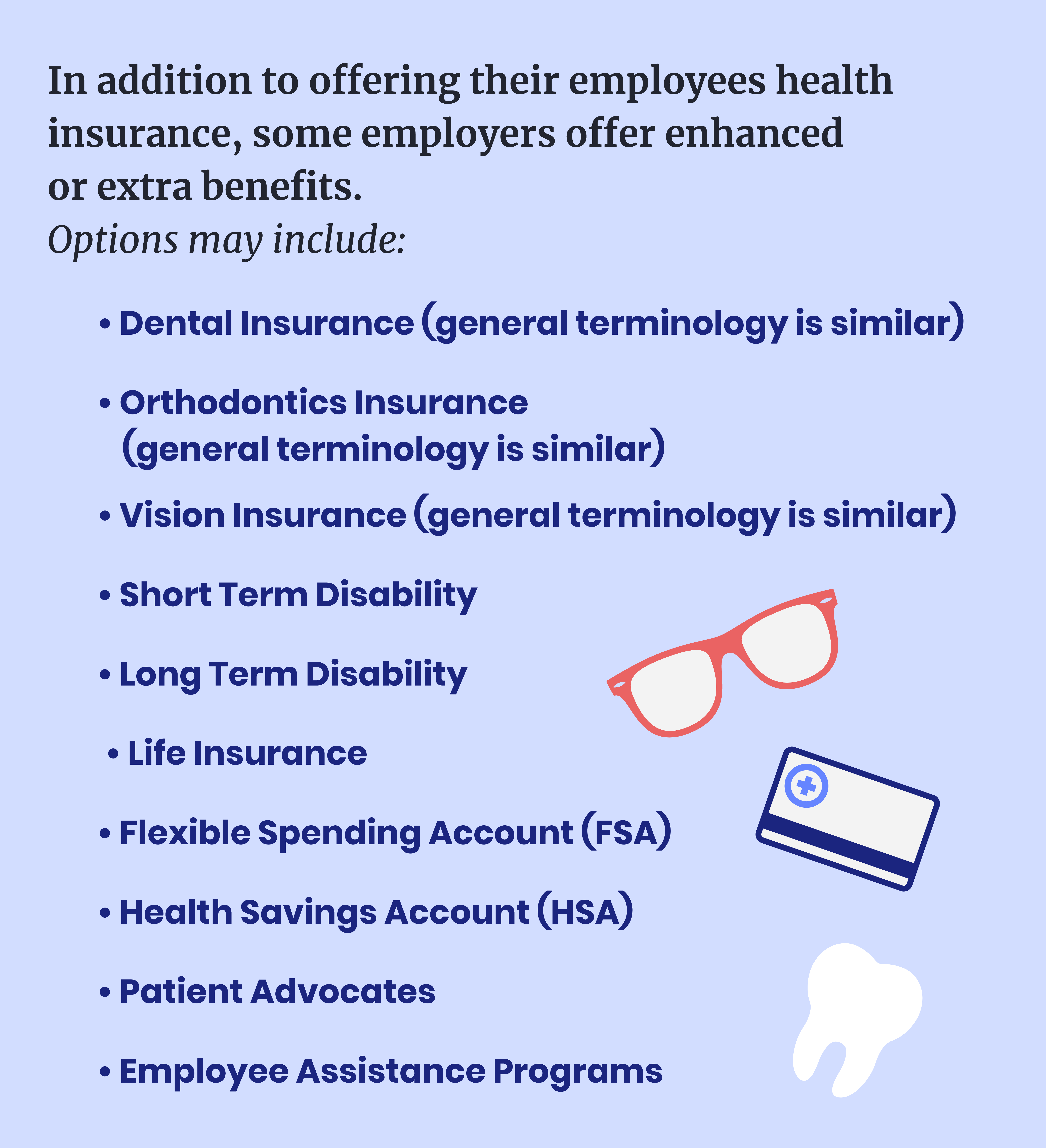

In addition to offering their employees health insurance, some employers offer enhanced or extra benefits. Options may include:

- Dental Insurance (general terminology is similar)

- Orthodontics Insurance (general terminology is similar)

- Vision Insurance (general terminology is similar)

- Short Term Disability

- Long Term Disability

- Life Insurance

- Flexible Spending Account (FSA)

- Health Savings Account (HSA)

- Patient Advocates

- Employee Assistance Programs

One note: Before you enroll in dental or vision insurance, though, make sure you check your health insurance because you (or your kids) may already be covered.

Important Considerations

Suppose you have the privilege to choose between insurance plans. In that case, whether it’s through your employer, between you and your partner’s plans, or the marketplace, there are several factors to consider that can help you make the best decision for yourself.

How much will it cost? If you’re a generally healthy person and you’re only covering yourself, then you might be able to get a rough estimate simply by looking at the cost of your monthly premium. However, suppose you’re covering your kids or your whole family. In that case, if you have to see a specialist regularly or take daily prescription medicine that is expensive, you need to look beyond the premium.

- What are the family deductible and individual deductible?

- Most family plans have two separate deductibles (and out-of-pocket maximums), one for each family member and one for the family as a whole. If an individual meets their deductible, then you’re only responsible for their co-insurance for the rest of the year. However, you’ll still be paying more for other individuals’ bills until either they also meet their deductible or the family deductible is met (whichever comes first).

- What is the family out-of-pocket maximum and the individual out-of-pocket maximum?

- How much will it cost you to see your specialist regularly?

- What does your prescription coverage look like, and will your medications be covered?

- Are there extra charges for things like ADHD or Asthma management for your child?

If you’re paying a moderate premium every month, but all of these numbers are high, you may be better off with a different plan.

Which doctors are considered in-network? It takes a long time to find a doctor that you like and trust, and if you’ve been with them for years and they’re not in-network, that’s something to consider (assuming you have other options available).

Are the services you need covered? Most insurance plans cover standard services and treatments but they may not cover more niche treatments (despite how essential they may be to those who need them). Some examples:

- Fertility services and treatments

- Mental health services

- Including inpatient treatment for things like eating disorders or addiction

- Cosmetic surgery

- There are caveats (such as for reconstruction surgery), but insurance providers will usually require extensive evidence that a procedure is medically necessary if it is otherwise typically considered cosmetic.

- Routine foot care (i.e: seeing a podiatrist)

- Weight loss programs and/or surgery

If you or a family member has a rare or uncommon diagnosis, take extra steps to examine your insurance plan to see if it is covered. If not, don’t immediately count the plan out because you may have the option to file for an exception, depending on the condition.

The Homework Is Worth It

Between all of the different terms, parameters, and minor caveats, it’s pretty mind-blowing how complicated insurance is. Yes, there is a lot to learn, but with a solid understanding of how things work, you’ll be able to make intelligent decisions for your family during enrollment and ensure you are not being overcharged for any medical service. So, settle in, find your plan summary and start to get familiar with your insurance plan.

It’s about more than jobs. We’re making progress.

The Mom Projects connects skilled, diverse talent with family-friendly employers that respect work-life integration, and provides career support and connection to our community of talented moms and allies.