You’re probably already well aware that babies cost a lot of money. Between diapers, car seats, childcare and food, trying to estimate costs and create a budget can be overwhelming, especially if you’re not even sure what all you need.

We’ve been there. So, we’ve organized many of the common costs into categories to help make the information a little more digestible and less intimidating. We’ve also included a few long-term costs to start considering and some of our favorite money-saving tips we’ve learned along the way. Let’s get to it.

Medical bills

Bringing your baby into the world is so exciting, and a few weeks after you’ve settled back at home you’ll start getting bills for it. On average, the out-of-pocket costs for an uncomplicated labor and delivery range between $4,000-$6,000, which does not include the baby’s bills. Assuming you’re delivering at a traditional hospital, you’ll incur costs for both mom and baby for labor and delivery, mom’s postpartum care, baby’s newborn tests and delivery and nursery care. You can expect charges for general hospital fees, individual doctor bills and costs for any interventions.

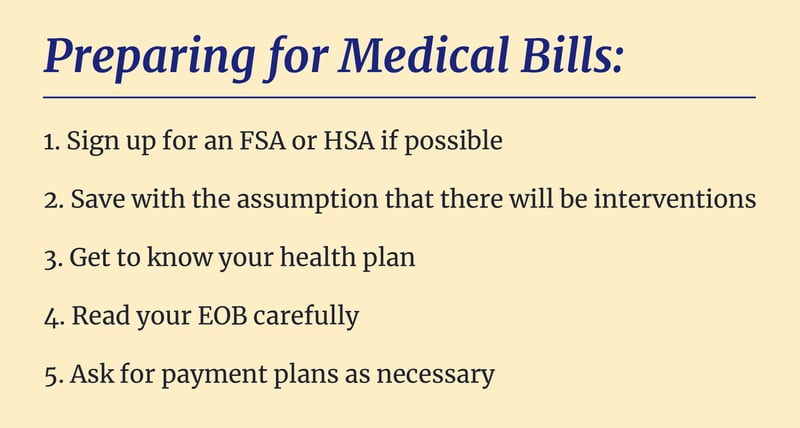

Tips for preparing for and saving on medical bills

1. Sign up for an FSA or HSA if you have the option

This will allow you to put pre-tax money into these accounts to pay for your medical bills. There is usually a maximum amount you can put toward each in a year, so make sure to save money outside of this account accordingly.

2. Save with the assumption that there will be interventions

Obviously, the hope is and odds are that everything will go smoothly. Saving up more than you think you will need will give you a little buffer in case the baby needs to be evaluated by a specialist, there is some kind of intervention during labor or delivery or if some other kind of special care is needed

3. Get familiar with your health insurance plan as soon as possible

Find out how much your individual deductibles are, what percent of bills you are responsible for after the deductibles are met, your individual out-of-pocket maximum and your family out-of-pocket maximum (if you’re putting your baby on your insurance plan).

4. Make sure the amount owed on bills matches your insurance provider’s explanation of benefits (EOB) statements

Medical providers sometimes try to make up for what insurance didn’t pay them by putting the charge on the patient, but you may not actually be responsible for it. If any amounts don’t match up, call your insurance provider to get more information so you don’t overpay. Also, if you received a bill but not an EOB, wait until you get your EOB to pay the bill to ensure you’re paying the correct amount.

5. Ask for payment plans if necessary

Most hospitals and medical providers will work with you if you can’t pay a bill off all at once, and they may even offer you a discount to get you to pay it off faster.

Maternity leave

If you’re taking time off work and your employer doesn’t offer paid maternity leave, you should prepare for that loss of income in advance. Make sure you have enough money saved up to cover bills and expenses during your time off. The sooner you do this, the better because you never know if you will end up going into labor early or end up on bed rest and unable to work.

You’ll also want to save up a little extra money for some clothes for mom. You might be able to get by in some of your pre-baby and maternity clothes, but your body will be changing rapidly so you’ll likely need a few new pieces to get you through.

Basics for the baby

As you prepare for the baby’s arrival, you’ll need enough money for the one-time cost of basic essential products. Here are some of the things you might need, and an average of where prices start:

- Car seat and bases: $100+

- Infant-safe stroller: $50+

- Video baby monitor: $100+

- Crib and mattress: $100+

- Bedding: $20+

- Sound machine: $35+

- Swaddles: $10+

- Burp cloths: $10+

- Diaper bag: $20+

- Rocker or glider chair: $100+

- Feeding supplies: $50+ (depending on needs)

- Pumping supplies: $50+ (depending on needs)

- Packs of pacifiers: $10+

You may also want products like a playard, activity mat, bouncy seat or swing, sleep sacks, a travel system, changing table, portable high chair and more.

👉 Tips for saving on the basics

✅ Register for these items if you’re having a baby shower

✅ Ask friends if they have anything you can borrow (make sure to ask if they want it back when you’re done using it)

✅ Shop at consignment sales and stores in your area

✅ Check out local yard and garage sales

✅ Browse a trustworthy Facebook Marketplace group

Necessities for the baby

Necessities are the ongoing costs you can expect once the baby arrives. This includes health insurance premiums, nursing and feeding needs, diapers, wipes and clothing. You’ll gradually spend less on the necessities as your baby grows. For instance, the cost of diapers and wipes will decrease over the first year, as changes will become less frequent, and you’ll likely need new clothes less often as the baby gets closer to 12 months and into the toddler years.

Monthly cost estimates:

- Diapers - $50+

- Wipes - $10+

- Formula - $70+ (if exclusively formula feeding)

- Clothing - $30-40+

Tip for preparing for and saving on the necessities

Assume you’re going to feed with formula, even if you don’t plan to. This will ensure you have the wiggle room in your budget in case you need to supplement or decide you wean earlier than you anticipated.

- Look for diaper and wipe bundles, and buy in bulk

- Ask for hand-me-down clothes (and find out if they need to be returned)

- Ask for samples at the pediatrician’s office, they often have formula, diapers, and wipes stashed away for patients

- Sign up for formula coupons

- Make your own pureed food when you start moving to solids (if you have the time)

- Always check out the sale racks, consignment shops, Facebook groups and yard sales for clothes

Childcare

Your childcare costs depend a lot on whether you choose to hire a nanny, send your child to an in-home daycare, daycare center or a church preschool. On average, though, expect to pay $10,000+ (depending on your area) for one year of childcare tuition. It’s important to note that if you’re using a center, your baby’s first year of childcare is often their most expensive because of the higher teacher-to-student ratio. Tuition will slowly decrease as they get older.

It’s smart to set aside a little each month for additional costs like teacher appreciation and holiday gifts, school photos and party supplies (even nine-month-olds need napkins for their class Valentine’s Day party). You should also budget your vacation time to account for days the school is closed or your nanny has off, as well as your sick days because babies tend to share germs and you’ll probably be staying home with your little one a bit throughout their first year.

Tips for saving on childcare

- If you work in public service or as a teacher, ask if they offer a discount (many places do!)

- Ask about part-time options, if you have a flex-time schedule you may be able to pick your child up earlier in the day and pay less since it’s not a full day

- Shop around, centers with all of the bells and whistles are often more expensive and aren’t necessarily better than the more modest family-owned preschool down the street

- Send the teachers small thank you notes throughout the year so you feel less pressure to make a grand gesture during the holidays and Teacher Appreciation Week

The extras

If, after all of the other expenses, you still have some wiggle room in your budget you may want to get ahead a bit by saving for and investing in things that are more long-term. These are just some nice-to-haves for financial padding as your baby gets older. Here are a few:

- Modest medical savings account for unplanned trips to the ER, common childhood procedures like ear tubes, dental work/orthodontics and vision needs

- Life insurance for the family including yourself, your partner (if applicable) and the kids

- College savings account

- Funds for future vacations (Disney World isn’t cheap!)

It’s worth the cost

Looking at these numbers all at once might take your breath away, but remember that a lot of the baby basics are one-time purchases and most of the monthly necessities decrease as your baby grows. It won’t take long for you to get used to your new budget once the baby arrives, and when they age out of things like formula and diapers it’ll feel like you’re getting a mini raise.

Yes, the first year is expensive, but preparing for it early will make your budget a lot easier to manage. Don’t forget to allocate a little to yourself every month, too, even if it’s just enough for the occasional candy bar or cup of Starbucks, you deserve a treat now and then, too.

Get support throughout your journey

Get access to career opportunities with family-friendly employers, job search and career development resources, and a thriving community of moms and allies with The Mom Project.